A smarter CPA means smarter tax advice

Town’s AI-assisted CPAs focus on strategy—not busywork—so your small business gets better tax planning, bigger savings, and faster filing.

How it works

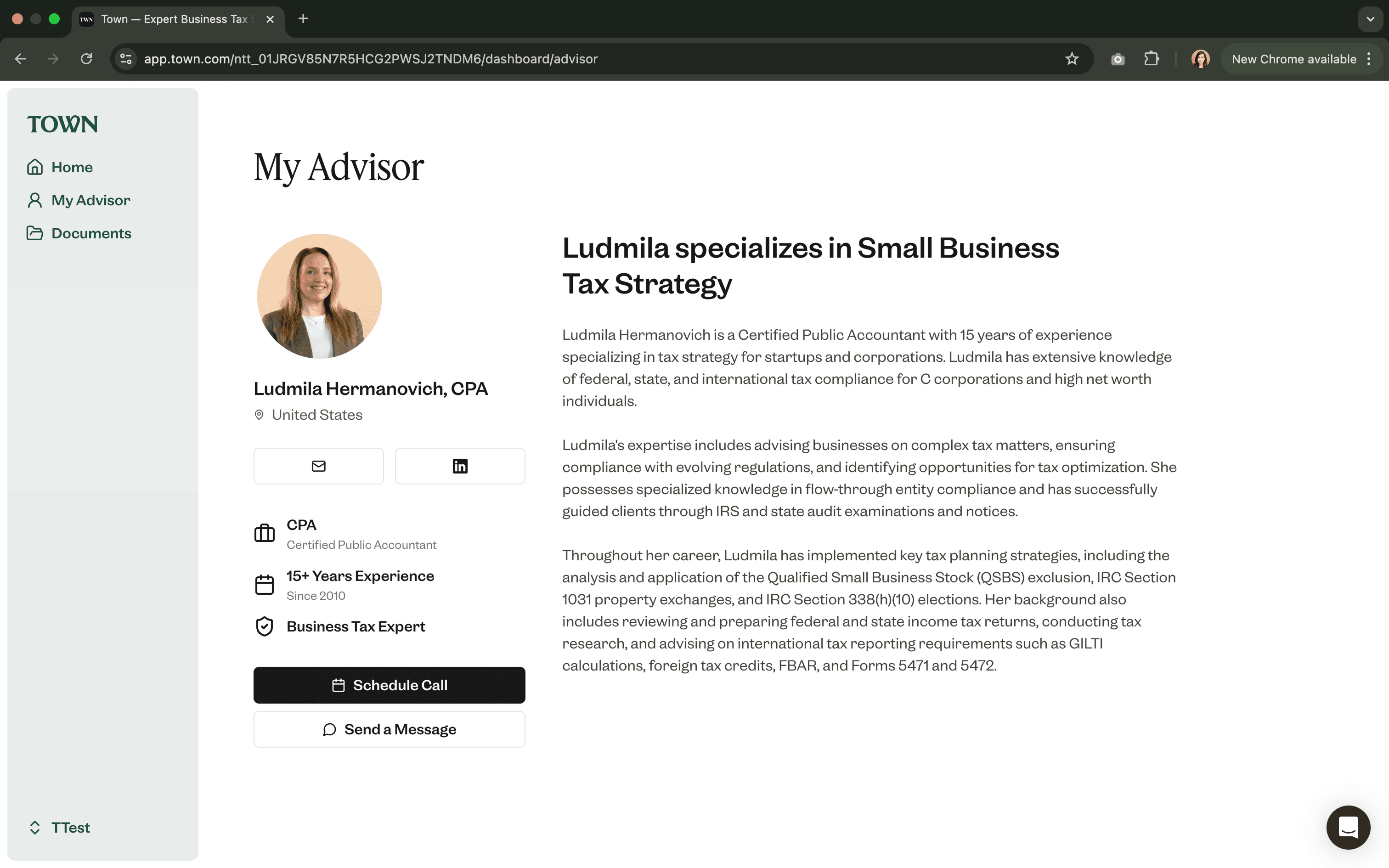

Step 1: Meet your dedicated Town CPA

One AI-assisted tax expert who knows your business—and sticks with you year after year. Always responds within 24 hours.

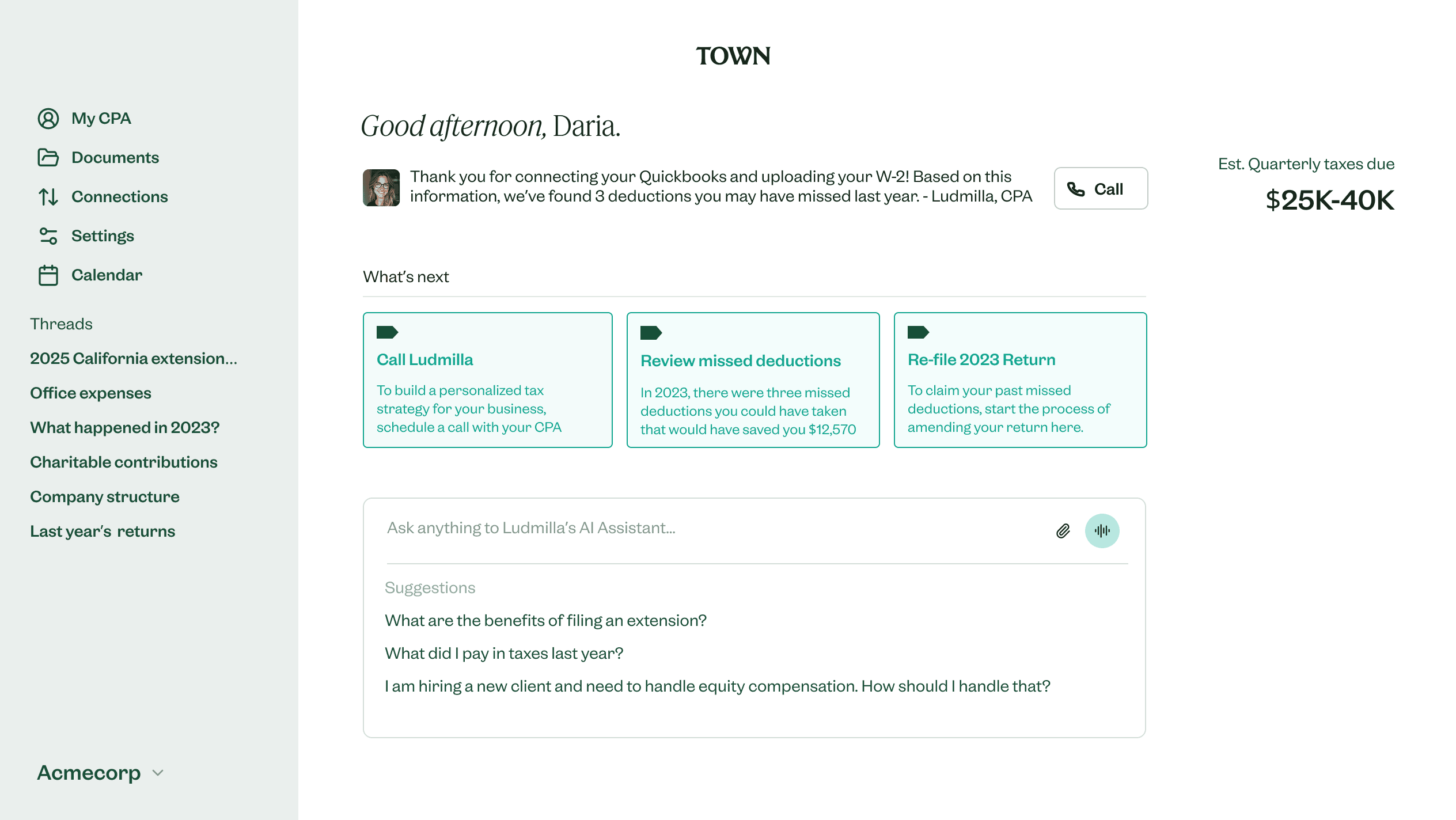

Step 2: Access your personalized dashboard

Town’s AI connects seamlessly and privately with your bank accounts, payroll, accounting tools, and tax history—giving you and your CPA an up-to-the-minute view of your tax position. Your personal dashboard will always help you stay on top of what’s done, due, and next.

Connect your accounts

Reduce busywork to find forms by connecting Quickbooks, Gusto, Carta, and/or your bank(s) so we can assess your tax situation efficiently

Real-time tax information

Our up-to-date tax platform flags tax code updates, tax credits & incentives, and potential issues before they become a problem.

Access answers

Clarify the confusion around taxes by getting answers from your CPA within 24 hours or your CPA's tax AI-assistant instantaneously

Step 3: Build your tax strategy

In your first meeting, you and your CPA build a strategy—one that saves you money, optimizes deductions, and accelerates your growth.

Step 4: Get answers on your timeline

Questions come up fast. With your CPA and AI plugged into your business, answers do too. Your CPA will respond within 24 hours, and Town AI is always available for the quick things.

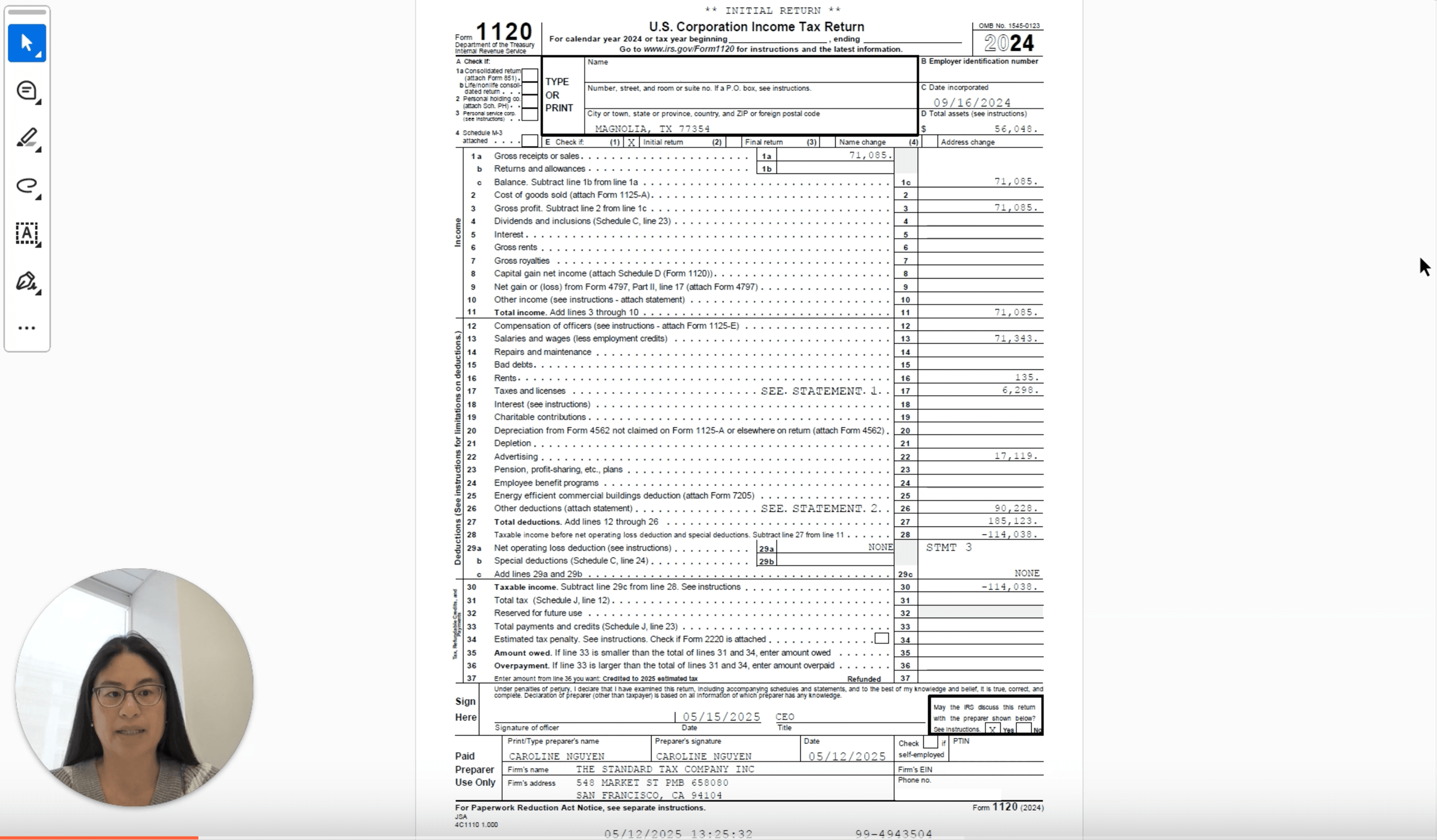

Step 5: Stress-Free Filing

Your CPA sends a video walkthrough of your completed taxes that contains highlights of what's due, your deductions & credits, and tips for next year's taxes

Ongoing: Stay ahead with year-round support

Your CPA checks in every quarter—adjusting your strategy, flagging new opportunities, and keeping you two steps ahead.

Smart matches

Ludmilla Hermanovich, CPA

- Experience:

- Trusted advisor to small businesses across retail, tech, and professional services. Specializes in simplifying complex tax matters and delivering year-round support.

- Tax Focus:

- Business tax strategy, S corp optimization, and multi-state filings

Alex Carter, creative agency

"I was so tired of working with CPAs who didn't understand creative agencies and didn't get back to me in a timely way. Ludmilla is the first CPA I've ever worked with who just "gets" my business and is always responsive. She saved me an additional $10,000 this year -- so now I tell every business owner I know about Town."

Anjum Tunuli, CPA

- Experience:

- Specializes in startups who want to optimize their tax strategy and stay ahead of compliance issues.

- Tax Focus:

- LLC and S corp filings, quarterly planning, and IRS resolution

Sofia Nguyen, Start up founder

"I first was introduced to Town by filing a free tax extension and quickly learned with them that I could get an R&D credit that I hadn't been claiming. They've been so easy to access, and I use the Town AI chat anytime I need a quick answer -- SO convenient and fast!"

Flat fee pricing

Our pricing plans are built for any size of business, so Town can work with you year-over-year as your business grows. Personal returns can be added to any plan as well.

Single Owner Business

For single-member LLCs/S corp + personal return

- Dedicated CPA who provides tax strategy, planning, filing, and on-demand support

- One clean dashboard with searchable W-2s, 1099s, past returns, and instant AI answers

- (1) Federal tax return for a single-member LLC passthrough or S-Corp (1120S) included

- (1) State income tax return included

- (1) City income tax return included

- $1000 per additional single-member LLC passthroughs or S-Corp (1120S), $500 per additional state/city/personal tax return

- Free tax extension

Standard Business

For C-corp, multi-member partnership, LLC or S-Corp

- Dedicated CPA who provides tax strategy, planning, filing, and on-demand support

- One clean dashboard with searchable W-2s, 1099s, past returns, and instant AI answers

- (1) Federal tax return (1120, 1120s, or 1065) included

- (2) Schedule K-1s

- (1) State income tax return included

- (1) City income tax return included

- $1000 per additional single-member LLC passthroughs or S-Corp (1120S), $500 per additional state/city/personal tax return

- Free tax extension